(Policy Administration Platform)

InsuranceSuite (Policy Administration Platform) provides a total customer-centric solution for Insurers which covers all key operational functions, for example, product development, marketing, intermediary management, underwriting, policy management, reinsurance, claims, payment and accounts. Although designed on a modular basis, all the various functions are seamlessly integrated. Requirements for quick and real time information may be obtained with little hassle to make important operational decisions. InsuranceSuite also incorporates the e-CMS (or electronic Claims Management System) which can be implemented on a stand-alone basis, if needed.

The e-CMS incorporates a built-in workflow and document management system which helps to avoid the current shortcomings of claims operations. The workflow system allows different setups for the various products by product type, loss amount, loss type, etc to ensure the different processes within the set benchmarks are consistently met. The system is able to monitor the performance of the staff and for work to be reassigned in the event of bottlenecks.

(Digital Experience Platform)

The customer-centric InsuranceSuite (Digital Experience Platform) is offered as a Software as a Service (“SaaS”) solution to the insurance industry. This has helped to address the various issues arising from the biggest concerns in IT investments, namely the high capital expenditure, difficulties in retaining IT expertise, the technology risk, and the high costs of operating and maintaining IT systems. The InsuranceSuite (Digital Experience Platform) system is charged on a ‘pay per use’ basis.

The InsuranceSuite (Digital Experience Platform) system has all the functionalities to support agencies of any size. It enables the bigger agencies to work in a collaborative manner while enabling the smaller ones to have similar functionalities as the ‘big’ boys.

The InsuranceSuite connectivity to various parties, allow seamless services to be offered to its customers. Furthermore, InsuranceSuite not only provides end-to-end solutions electronically, creating a paperless environment which helps reduce the inefficiencies of the current manual processes, it allows insurance policies and confirmations to be printed at the point of sale.

The InsuranceSuite system was awarded the Asia Pacific ICT Alliance (“APICTA”) Merit Awards for the local and international “Best of Financial Applications” categories in 2006.

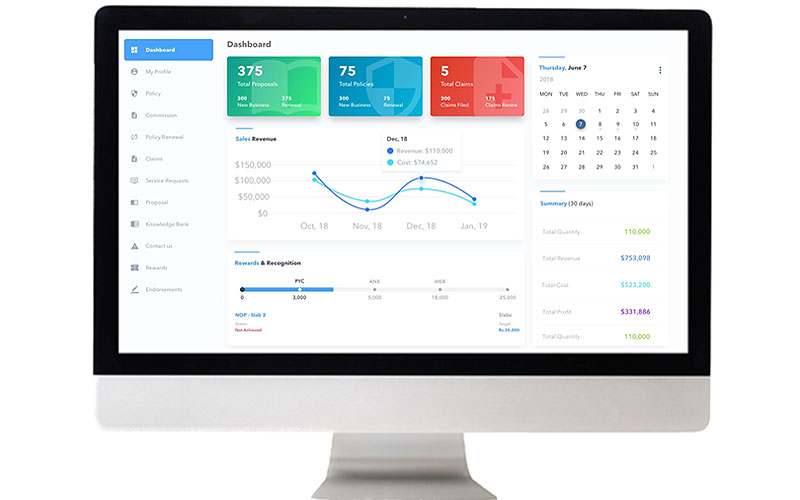

Agency Portal is a web based mobile responsive portal which provides a comprehensive digital solutions, in order to improve user experience with quick direct integration. The portal aims to ensure the availability of the necessary features for agents to carry out the management of its customer's portfolio/policies with the Insurance Company.

The portal consists of reporting functions which allows vary report that supports agents throughout the customer life cycle. It addition to that, the portal provides a powerful calculation tool to allow agents to monitors their sales by using chart, graph, table in a single glance, and this enables agent's ease of doing business.

The portal allows registration agents for e-learning, training or event, which increases retention of agent with better customer experience in the portal.